FIND OUT WHAT YOUR HOME IS WORTH

The Home Selling Process Checklist

The home-selling process typically starts several months before a property is made available for sale. I recommend getting a preparing to sell your home checklist to review. Please contact us and we can provide you with a checklist. 704-315-1642 or inquiry@patelstandardrealty.com

It’s necessary to look at a home through the eyes of a prospective buyer and determine what needs to be cleaned, painted, repaired and eliminated.

Ask yourself: If you were buying this home, what would you want to see? The goal is to show a home that looks good, maximizes space and attracts as many buyers as possible. While part of the “getting ready” phase relates to repairs, painting, staging and other home improvements, it is also a good time to ask why you really want to sell.

Selling a home is an important matter and you should have a good reason to sell, perhaps a job change to a new community or the need for more space. Your reason for selling can impact the negotiating process, so it’s important to discuss your needs and wants in private with your realtor who lists your home.

WHEN SHOULD YOU SELL?

The Home Selling Process Checklist

The home-selling process typically starts several months before a property is made available for sale. I recommend getting a preparing to sell your home checklist to review. Please contact us and we can provide you with a checklist. 704-315-1642 or inquiry@patelstandardrealty.com

It’s necessary to look at a home through the eyes of a prospective buyer and determine what needs to be cleaned, painted, repaired and eliminated.

Ask yourself: If you were buying this home, what would you want to see? The goal is to show a home that looks good, maximizes space and attracts as many buyers as possible. While part of the “getting ready” phase relates to repairs, painting, staging and other home improvements, it is also a good time to ask why you really want to sell.

Selling a home is an important matter and you should have a good reason to sell, perhaps a job change to a new community or the need for more space. Your reason for selling can impact the negotiating process, so it’s important to discuss your needs and wants in private with your realtor who lists your home.

WHEN SHOULD YOU SELL?

SIGNING A LISTING AGREEMENT IN NORTH CAROLINA

Once you find a real estate agent you want to work with, you’ll sign a “listing agreement” giving the agent the right to market and handle the sale of your house. Our real estate agency use forms created by their state or local Realtor association, such as the North Carolina & South Carolina Association of Realtors.

Listing agreements normally cover the following terms:

- The real estate agent commission that you (the seller) will pay. This typically a percentage of the home’s sales price and is split between your real estate agent and the buyer’s agent.

- Duration of listing. In all cases, the listing agreement will cover a set amount of time, commonly 3 to 6 months.

- Duties and obligations of seller and real estate agent. Your agreement will spell out how the real estate agent will list or market your house, what type of insurance you must maintain on the property, and what disclosures you must make.

Several factors, including market conditions, interest rates and market comparably will determine how much you can get for your home. Home selling is a 3 part process: data driven, marketing, and negotiation.

Many homeowners want to set their list price based on what they paid for their home, the balance of their mortgage, or the profit they want to make so they can move into another home. In reality, your home is worth only what the market will bar. If you price your home too high, some potential buyers won’t want to look at it at all, while others will simply walk away without making an offer.

You may be tempted to pick the sales professional who suggests the highest price for your property. But sellers, like buyers, need to beware.

Real estate agents who will provide the best comparative market analysis and explanation of how your home should be priced will be more likely to sell your home quicker and for a higher price than someone who tells you only what you want to hear.

A realtor will have access to advanced software to market data. A comparative market analysis should include sales prices for similar nearby homes that sold in the last 6 months. In addition, many Realtors include prices for homes currently on the market that will be your competition, as well as homes taken off the market because they didn’t sell. Other data our Realtors can use to suggest a price range include the amount of days a home was on the market at various price points and the average difference between the list prices and sale prices on homes that have sold. Finally, comparing the price per square footage of comps, age difference on the home sold, assessments, HOA considerations and much more.

State law in North Carolina (North Carolina Gen. Stat. § 47E-4) requires that sellers provide buyers a disclosure form, which sets forth the following details about the property:

- issues with the plumbing, electrical, heating, cooling, and other mechanical systems

- water source and sewage system

- issues regarding the roof, chimney, floor, foundation, and other structural components

- environmental conditions such as pest infestation, or the presence of asbestos, radon, methane, or other hazardous materials

- legal issues, such as zoning violations, homeowner's association involvement, building codes, and

- other specified details of the property

In addition to the above disclosures, sellers must also disclose whether the property comes with mineral, oil, or gas rights (see North Carolina Gen. Stat. § 47E-4.1).

In addition, if your house was built before 1978, you must comply with federal Title X disclosures regarding lead-based paint and hazards. See the lead disclosure section of the EPA’s website for details.

Disclosures must be made on a Residential Property and Owners' Association Disclosure Statement form created by the North Carolina Real Estate Commission.

Sellers in North Carolina can hire an inspector to inspect the home and provide a written report, in lieu of filling out the required disclosure statement (though the mineral rights disclosure and homeowners' association disclosures are still required). If you choose to have an inspector provide a written report, then you are not liable for any mistakes in the inspector's report (see North Carolina Gen. Stat. § 47E-6). Certain types of sales (such as lease to own) are exempt from state disclosure rules.

MARKET YOUR HOUSE FOR MAXIMUM EXPOSURE

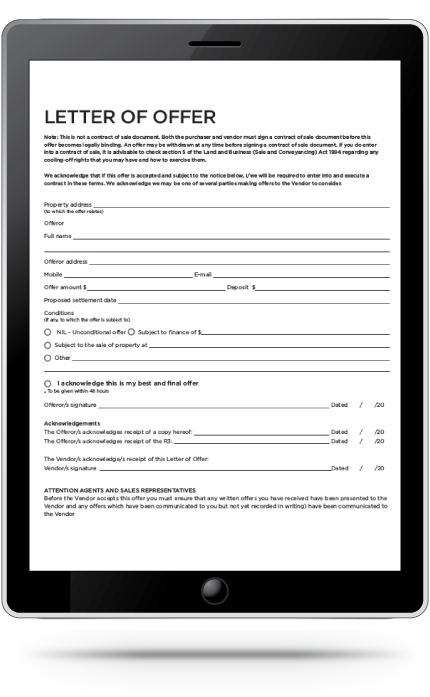

WRITTEN OFFER FROM A POTENTIAL BUYER

The contract, though not limited to this list, should include the following:

- Legal description of the property

- Offer price

- Down payment

- Financing arrangements

- List of fees and who will pay them

- Deposit amount

- Inspection rights and possible repair allowances

- Method of conveying the title and who will handle the closing

- Appliances and furnishings that will stay with the home

- Settlement date

- Contingencies

Most offers to purchase your home will require some negotiation to come to an agreement. Patel Standard Realty is well versed on the complexities of the contracts used in our area and we will protect your best interest throughout the bargaining process. Our expertise allow us to decode contract clauses, evaluate net sale particulars and neighborhood nuances. Once both parties have agreed on the terms of the sale, your realtor will prepare a contract. The transaction will go into escrow once a purchase agreement is signed buy both the buyer and seller.

.

ESCROW

The buyer will complete the following tasks during escrow:

- Finalize financing

- Remove all contingencies

- Property appraisal (typically required and arranged by the mortgage lender)

- Title Insurance (usually under deadlines detailed within the purchase agreement)

Negotiations such as who will pay for repair problems identified in an inspection report take place during this process. The buyer may insist seller pay to remedy a defect or lower the purchase price. If an acceptable agreement can not be reached, the buyer may have the right to back out of the deal.

Your REALTOR® at Patel Standard Realty will lead the effort and serve as your advocate when dealing with the buyer’s agent/service providers.

By the close of escrow (known as the closing or settlement), you and the buyer should have fulfilled all the terms of your purchase agreement. At the closing itself (unless a meeting is agreed upon between both parties), all final documents and funds will be exchanged between buyer and seller.

The buyer pays you the purchase price, and the seller gives the buyer a deed and other transfer documents including a clear title to the property. You pay off any outstanding loans on your property and pay commissions to the real estate agents (based on listing agreement).

The closing normally takes place over the course of one day, but it's also possible for it to go over several days.

Sellers do not usually need to be present at a North Carolina closing, so long as all costs are paid and documents are signed. The sellers' attorney will forward all the necessary paperwork to the buyer’s attorney.

The buyers will sign the final documents at their attorney's office and pick up the keys. Then the buyer’s attorney will record the new deed in the buyers' name at a local government office, and the home is officially theirs.

Your REALTOR® will be present during the closing to guide you through the process and make sure everything goes as planned. By being present during the closing, he or she will mediate any last-minute issues that may arise. After the closing, you should make a “to do” list for turning the property over to the new owners. Here is a short checklist to get you started.

- Cancel electricity, gas, lawn care, cable and other routine services. If the new owner is retaining any of the services, transfer the name on the account.

- Gather owner’s manuals and warranties for all remaining appliances.

As mentioned above, North Carolina requires sellers to involve a lawyer in the house-selling transaction. In addition to taking care of paperwork, escrow, and closing, a lawyer can also help in unusual situations, such as if you need to draft a lease agreement to rent the house back after the sale.

PLAN YOUR MOVE

MONEY

MEDICINE

MOVING FRAGILE ITEMS